Latest Activity...

Please contact us at help@ownerreservations.com for instructions on how to connect your OwnerRez account to the HA/VRBO API.

So from a practical standpoint, what do I need to do in order to tie my OwnerRez account with their API? Thanks!

No. If you are not using our API connection to HA/VRBO, you'll be still paid according to their policies. If you are using our API connection, you'll be paid in accordance with your agreement with your credit card payment processor you have chosen and configured in OwnerRez.

Does this change anything about how and when we get paid for reservations through Vrbo?

@Alex: please contact our help desk (help@ownerreservations.com) for questions about that. There are options available that we are not publicly able to advertise yet.

Does the preferred partner status give any boost in rankings within VRBO?

Need API for <5 properties ASAP

Great work

Congratulations are very well deserved by your awesome team!

Well done, OwnerRez!

Over the past year, OwnerRez has experienced a lot of growth. Even during the covid hysteria, we've continued to grow at a fast pace. We know we owe some of that growth to our awesome users because you talk to each other and spread the word.

Some of you have jokingly mentioned that you should be on the payroll. Well now... maybe you will be.

As we grow, it’s very important to us that we maintain the high quality of support that we are known for. So, what better place to find new employees than among our clients, who already know what OwnerRez can do?

We are looking to fill several positions in online support - basically, the other end of the help@ email you know and love. 😉

Software development skills are not required, nor does it matter where you live, as OwnerRez is an entirely-virtual company.

All that’s needed is a a warm personality, knowledge of OwnerRez, a decent computer and Internet connection, and a reasonable place to work. We are looking for both full-time and part-time staff.

If you are interested in this opportunity, please write to hr@ownerreservations.com with:

Is there an update yet on Master Cancel?

Yes, still true! Price Consistency is built into the API side. If you're using it, you're fine. On the non-API side, it's up to the user to make sure they are price consistent.

Regarding Price Consistency, and just to make sure, other info in OR says:

"First: this only applies to API connections. If you are not using our HA/VRBO API, it's entirely irrelevant.

Second: OwnerRez's API connection fully supports their requirements.

So you don't need to worry, you're compliant, and your property ranking will not be harmed."

All of that still true? API folks can ignore? What about non-API folks?

Happy Friday everyone!

Vacation properties are seeing a surge of bookings, especially now that states are reopening and loosening health and safety restrictions. A typical summer vacation may take the family for a week or two to the beach or mountains. This year, as many employees have been shooed from the office and summer camps have been canceled, many travelers are vacationing for a bit longer. Angela Rice, a co-founder of Boutique Travel Advisors in the Scottsdale, Ariz., area, said that some clients are looking at rustic long-term rentals near lakes, trails and waterfalls. She has received inquiries from clients with children who are looking to take road trips to a “lodge, ranch, ski resort town,” or anywhere with stand-alone lodgings and outdoor activities. Many travelers are ready to depart immediately, perhaps because they have cabin fever, feel more comfortable as officials relax restrictions or are unsure about booking too far into a future with hazy conditions. Evolve Vacation Rental, which manages 14,000 vacation homes across the country, said trips booked within seven days of departure are up 300 percent compared with last year.

Vacation rentals can reopen in 49 Florida counties after state officials cleared seven more safety plans Wednesday. Bradford, Columbia, DeSoto, Leon, Polk, Pasco and Seminole counties are joining the nearly three quarters of Florida’s 67 counties free to offer short-term vacation rentals. Those plans, going into effect immediately, will locally reverse Gov. Ron DeSantis‘ statewide ban from late March.

VRBO has introduced the Price Consistency program. What does this mean for you? OwnerRez is fully price consistent if you use the HomeAway API. So basically you have nothing to do, you will be price consistent by default. Here are some of the benefits for property managers who choose to be Price Consistent:

To learn about what will happen to property managers who do not adopt Price Consistency by August 31st, read more here.

Two and a half months into social distancing, affluent city-dwellers are buying homes in rural areas, and some are even doing so sight unseen. In New York state, the COVID-19 PAUSE policy means that traditional showings are verboten. "We're getting offers on virtual showings alone," says Howie Guja, a real estate agent at Old Purchase Properties in Bellport Village, New York, a rural community about 90 minutes from Manhattan. Jessica Lautz, the vice president of demographics and behavioral insights at the National Association of REALTORS®, says that about a quarter of the realtors her association represents report they've made a sale in the past week to a buyer who had only seen the home virtually. "Rentals are approximately 20% higher this year than last year, conservatively, and while there are some short-term rentals in the mix, we are mostly seeing long-term rental deals being done," says Cody Vichinsky, the co-owner of Bespoke Real Estate, which lists Hamptons properties valued at $10 million or more. "I’ve never seen the type of increased energy like we’re doing this quarter."

Have a fantastic weekend!😊

l

Hey Lydia. No one really has experience with it as it's brand new. There is only one carrier that I know of offering it and only two PMS systems that currently have it integrated. There might be more, but that's my general knowledge. You do need to have 5 or more properties to get underwritten, I believe. They wanted 10 or more, but it sounds like they'll approve you if you use OR and have 5 or more - that's what came out in the last meeting we had. We can ask on a case by case basis if they'll accept smaller users but that's the general understand at this point.

Paul W. - Is this something you guys have experience with: folks who use it, how to use it, whether it improves your ability to get bookings? Do you know enough about it to know if it's available to little fish or do you have to be a big property manager?

Many of you reading this may already be using our Hosted Website feature.

If not check out some great examples like ShenRent, Sasquatch, MT Shasta, CB Borrego, Dawn's or Mountainside.

Hosted Websites has some solid features, but we're in the middle of designing some great new ones.

Please let us know (survey below) what you need for your hosted site. What's bothering you about it? What do you see on other VR websites that you wish your website had?

(make sure to scroll to the bottom and click the Submit button)

It's around 5% of your booking total - Master Cancel. In exchange, you get an extremely flexible cancellation policy where the guest can cancel all the way up to 2 days before arrival, and the carrier will cover your cancellation refund, no questions asked. There are no qualifying reasons or types of cancellations that are covered - they are all covered across the board. There's a 10% deductible and if you successfully rebook they will refund the difference between the new and old booking with 0% deductible (they want to incentivize you rebooking).

We are pleased to announce that we have partnered with RueBaRue to provide advanced guest communication tools.

RueBaRue now integrates seamlessly with OwnerRez software to help vacation rental property managers save time, optimize operations, and liaise with guests.

RueBaRue Guest Communication Platform helps property managers use smart messaging to communicate with guests, schedule automated text, and email delivery of guestbooks and area guides, respond quickly to guest questions using the property manager app.

With the integration, guestbooks will be created in seconds, and you will have RueBaRue up and running within a few hours.

Here’s what a vacation rental company in San Diego has to say about RueBaRue:

"A game-changer for our Guest Services Department. People aren’t calling in asking how to use a TV or where exactly to park because it’s all there in detailed step-by-step photos. And their customer service and support team are the best."

Schedule a 30-Minute Demo at https://www.ruebarue.com/schedule-a-demo

Learn how to Integrate RueBaRue with Your OwnerRez Account.

Another week, another update. Make that 22 updates. 😇

Let's run through it...

Ethernet is now an amenity that can be selected in addition to the others. It does not replace Internet or Wireless/WiFi. This is useful because some users want to point out that their internet handles Wireless/WiFi connection in addition to hard-line ethernet connections. Business travelers often look for the hard-line ethernet type.

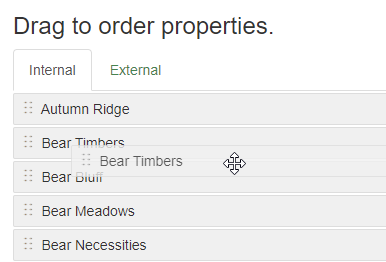

You can now order properties explicitly in OwnerRez. For a long time, users have wanted to order by different types of fields (codes, internal names, external names). Forget all that... You can now specifically set the internal and external order of properties.

Head on over to the Properties menu, click the Display Order button and you'll get two drag/drop lists. Drag your properties around and click save.

Head on over to the Properties menu, click the Display Order button and you'll get two drag/drop lists. Drag your properties around and click save.

Internal and external are exactly what you think they are - internal is inside of OwnerRez's control panel and external is what guests see on public facing features like websites or widgets.

When downloading renter agreements as PDF or showing them on HomeAway API, we now fully render your account information instead of the field codes. Before, the renter agreement might have shown "the owner {MYFULL}" but now it will say "the owner Joe Blow". This so that the agreement can show the owner info when the guest previews it as a sample, even before they go to sign later on. To be clear, we do not render any email address or phone number fields for privacy purposes.

You can now check the DNS records on your hosted website directly from OwnerRez. Wondering why an SSL certificate hasn't been generated or why the live domain name didn't map over yet? Pull up your hosted site, drill in and click the Check DNS button right there by the location fields.

This will show you what OwnerRez sees when we look at your domain name. We'll tell you whether it's configured correctly or something is off. If it's off, you'll see the IP address that we see.

Why get 12 months of spot rates when you can get 24 months instead? Our spot rate import (ie. with channels like Airbnb) now automatically scoops up 24 months of rates at a time instead of 12. To be clear, this is the manual one-time import on spot rates, not an API integration, dynamic pricing or anything else.

Listing Quality Analyzer (under the Tools menu) now checks longer time periods when analyzing rates even if min/max rules are set. This helps scenarios where rates are valid for longer periods of time but the min/max rules don't allow those rates to be used or applied.

On the Email History report, the To filter is now a type-ahead of guest names and email addresses. This allows you to quickly narrow down a guest by name or email instead of guessing or looking elsewhere.

Not quite sure how Katie's name is spelled? No worries, just type a few characters and see what comes up.

Speaking of guests, we also added a Status column to the guest Related Activity list. This helps clarify the type of bookings or quotes you're looking at, for instance when there are several cancelled. You can filter on it as well using the filter button above the list.

There are a lot of lists and options in OwnerRez. Your API integrations show a running log of Sync Actions for instance - we do this to give you transparency into the process. However, sometimes you're hit with information overload and can't find what you need because the information you don't need is in the way. To help with this, we added some filter options to the Sync Actions list on API integrations. Want to find where a sync with Airbnb recently error'ed? You can now do that.

We clarified the Tax Registration Number fields to point out that max length only applies to VRBO, not Airbnb. Speaking of Airbnb and taxes, check out this new tax article specifically for Airbnb taxes.

On the Email History report, we updated the Entity ID filter box to automatically strip extra text from the number that is entered.

VRBO reviews not downloading in Channel Bridge. VRBO changed the data format of their Reviews, under the covers, and Channel Bridge could not download them. This was fixed.

Booking total in Tax report. The Tax Summary report showed conflicting booking totals when bookings with no tax results were selected based on specific listing sites (eg. Airbnb) versus all listings sites. This was fixed so that all booking totals would show even if the taxable charges were zero regardless of the listing site selected.

Property URLs with hash fragments. On certain widgets, property URLs were improperly appending parameters after the fragment (ie. hash tag portion) which led to incorrect results. This is now being detected dynamically.

Search widget property culture. The Availability/Search widget was not honoring the correct currency and culture (ie. date format) settings as set on the property. This was fixed.

Adjacent days when arrival is passed. We fixed triggers to ignore the arrival side on adjacent booking criteria if the arrival date has passed. This was causing issues where an automated email would offer the guest a deal, or point out open days, after the stay had already started.

Seasons not saving. If seasons had old rule values configured from legacy rates, the season would silently error when saving. No error message would show but the season would not save. This was fixed.

Damage Protection settings not picked up from calendar import (iCal) settings. Some of our more proactive users will run Channel Bridge on new bookings before the calendar import (iCal) engine picks up the new booking - this is perfectly fine and Channel Bridge will create the new booking. However, the Damage Protection rule was not beiung picked up from the calendar import (iCal) settings since the calendar import hadn't run yet. We fixed this to check and detect if there are calendar import (iCal) settings when Channel Bridge runs.

Listing Quality Analyzer crashes. We fixed LQA to not crash when there are no rates or when there is an Airbnb channel configured but no properties on the account.

Include Notes option not showing. On the Stays By Date Range report, we fixed it so the Include Notes option is honored even if Include Custom Fields is not selected. Previously, they both had to be selected.

Unknown feedback filter on Emails History. We fixed a bug with filtering by Unknown feedback only on the Email History list. That now works as expected.

Hey, BlueMtnCabins! It's a product from Rental Guardian. Go to https://www.mastercancel.com/. I did a little digging and saw a price quote of 4.4% of booking total - but I'm not sure how they define "Booking Total."

It would be great to be able to send text messages and have them set up to trigger at a certain time. I always try to send a welcome text to my guest on arrival dates but sometimes get busy and forget to do so. It would be a great feature to have

Autumn J said:

Master Cancel Please!! Having this available has the potential to put users back in control of their business during this crisis. When looking at a way to stay competitive, be at the front of the pack Master Cancel is the best option. Please keep working on moving this forward. Users, if you haven't researched the benefits of Master Cancel please take a look and image the potential benefits.Autumn J: Any idea the cost of Master Cancel?

Master Cancel Please!! Having this available has the potential to put users back in control of their business during this crisis. When looking at a way to stay competitive, be at the front of the pack Master Cancel is the best option. Please keep working on moving this forward. Users, if you haven't researched the benefits of Master Cancel please take a look and image the potential benefits.

As a relative newbie to OR, I'm struggling with getting everything set up and integrated. At least one of my channels only comes over with a block (HOUFY), so I'd love some additional integration. Also, because each platform is different, I'd love an editable booking workflow to ensure I'm not missing anything. (If you already have this, I'm sorry, I'm not seeing it.) I'd like to see the income split up into a rental income, with the housekeeping fees broken out.

And finally, an app would be awesome! I work on my mobile a LOT. Thank you!

Congratulations to the team !! Impressive

The official policies have not publicly changed, but we are running various experimental pilot programs in cooperation with VRBO engineers. Please contact the Helpdesk for more information.